No. 289

-

Japan is confronted with the medium- to long-term crises of an aging society and a population decline. Thus, fiscal expansion should not compromise fiscal discipline.

-

Similarly to the Special Account for Reconstruction from the Great East Japan Earthquake, expenses for COVID-19 countermeasures should be managed within the special account while enhancing the transparency of each program.

-

As a contingency plan in the event of a looming fiscal crisis, Japan should consider a one-time wealth tax.

To address the unprecedented crisis caused by the COVID-19 pandemic, the government of Japan has undertaken aggressive fiscal stimulus, formulating three large-scale supplementary budgets and consequently expanding general account spending to more than 170 trillion yen in FY2020. For now, there is no alternative but to finance the emergency expenditures by running fiscal deficits. More than 200 trillion yen in public bonds were issued in FY2020. The IMF has estimated that Japan's gross public debt will hit 260% of gross domestic product in 2020, up from 235% in 2019. The annual budget in FY2021 amounts to about 106 trillion yen, with a five trillion yen reserve fund to cover unanticipated COVID-19-related spending such as financial support for hospitals and businesses. If a "one-time" fiscal deterioration produces a quick return to normality, fiscal sustainability may not be jeopardized. However, there is the risk that a fiscal crisis might be triggered by a sharp rise in interest rates. Once the COVID-19 crisis is over, fiscal consolidation will be inevitable.

During this emergency, fiscal discipline seems to have been undermined. The transparency and validity of the consignment fees for the Subsidies for Sustaining Businesses (4.2 trillion yen) and the Go To Campaign (1.7 trillion yen) are now being questioned. The second supplementary budget of FY2020 included a contingency fund of 10 trillion yen. This may have been partially used for countermeasures against the second wave of COVID-19 infections, but the legislature's verification procedures have not been functioning sufficiently in this regard. Furthermore, the practice of needing to spend contingency funds in full by the end of the fiscal year leads to wasteful spending. Fiscal expansion should not compromise fiscal discipline. In addition to the appropriateness of the size of payments, the effectiveness of the spending, such as whether employment is actually maintained as a result of providing the Subsidies for Sustaining Businesses, for example, needs to be verified. Thus, any non-essential spending in association with the COVID-19 crisis should be postponed or reduced.

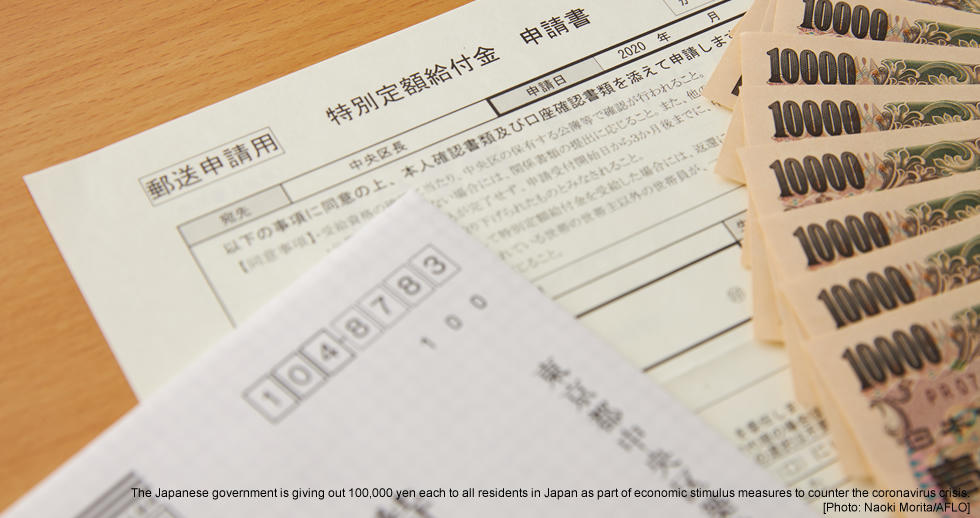

Drastic fiscal stimulus measures are strongly required from the perspective of facilitating rapid economic recovery, but only the size of the economic package has been prioritized and fiscal discipline seems to have eroded. Such a tendency to prioritize the size of the economic package may originate from a Keynesian trust in the value of public works, in which digging holes only to fill them up again is seen as a source of value. People with such beliefs insist that a project which seems wasteful at a glance may create jobs and income, thereby spurring demand. As long as money continues to flow into the economy, it does not matter whether you provide 100,000 yen uniformly or pay expensive consignment fees. However, such a view lacks a future-oriented perspective. Even though a economic package may temporarily stimulate demand, it is uncertain whether it will lead to "new growth" in the medium to long term.

On the other hand, many European countries have taken fiscal measures intensively focusing on sectors relating to future digitalization and the greening of the economy. Their fiscal measures aim to eventually enhance growth potential and combat global warming, and are not limited to measures for stimulating current demand. In contrast, the Japanese government's fiscal policy seems to be short-sighted. Japan continues to lag behind in digitalization and the current COVID-19 crisis has also revealed some other problems. Nevertheless, digitalization-related allocations only account for about 1% of the supplementary budgets. Wise forward-looking spending is urgently required. In the United States as well, fiscal mobilization of 200 trillion yen is being carried out, including a maximum of 150,000 yen in benefits per person. However, the difference is that the financial situation of the United States is healthier than that of Japan, and its economic recovery is also more solid.

Whether the overall size of public finances is under control is also in question. If the government cannot decrease spending once it has increased it, no brakes can be applied to the expansion of expenditures and national finances are highly likely to worsen further. The upper limit for each ministry's FY2021 budget request was eliminated. If soundness cannot be restored to national finances after the pandemic ends, maintaining social security and other social systems will become difficult. One option is to separate expenses for COVID-19 countermeasures from the general account so that fiscal expansion would not continue after the pandemic ends. Similarly to the Special Account for Reconstruction from the Great East Japan Earthquake, expenses for COVID-19 countermeasures should be managed within the special account while enhancing the transparency of each program. Funding sources for redeeming government bonds should be specified in advance and the terms of programs should be limited.

If the government continues to issue debt in such large quantities, with no clear plan for paying it down, the market could eventually lose confidence in government bonds. The Japanese government could continue to rely on the Bank of Japan to finance the budget for the time being, but the increase in the money supply could eventually trigger runaway inflation. Of course, moving too quickly to raise taxes could exacerbate the recession and put additional strain on household finances. Once the epidemic is over and the economic recovery well established, however, the government should assess the need for new taxes to repay the debt incurred by the coronavirus response, based on the size of the deficit and the strength of the economy. Any new taxes should target Japan's wealthier taxpayers. As a contingency plan in the event of a looming fiscal crisis, Japan should consider a one-time wealth tax on financial and real assets (savings, securities, housing, etc.) in excess of 50 million yen. Based on the 2014 National Consumption Survey, if a wealth tax of 5% were to be levied on five net assets of more than 50 million yen and less than 100 million yen, and a wealth tax of 10% levied on assets of more than 100 million yen, the tax revenue would be about 31 trillion yen. This is equivalent to the tax revenue from the consumption tax. Although there are administrative challenges in implementing a wealth tax, such a tax has been established in some countries. From 2010 to 2014, Iceland imposed a wealth tax on net worth of over 71 million yen at a tax rate of 1.5-2%. A wealth tax was also temporarily reintroduced in Spain (Yamaguchi (2015)). In both countries, the wealth tax was imposed as an emergency measure to cope with a financial crisis.

As a pessimistic scenario, the economic downturn (deflationary economy) may continue after the coronavirus pandemic. The economy might not have the strength to withstand fiscal consolidation. Ironically, the deflationary economy would continue to have low interest rates and a surplus of money in the private sector, and the pressure to undertake fiscal consolidation would be weakened accordingly. However, in this case, Japan's economy would become poorer. There is no choice but for the government to pursue both fiscal consolidation and economic revitalization.

The government maintains that now is not the time to consider fiscal reconstruction, but such a time will surely come. Japan is confronted with the medium- and long-term crises of an aging society and a population decline that will further deteriorate its fiscal condition. The government needs to reconsider a strategy for achieving the goal of restoring fiscal health, looking ahead to the post-COVID-19 era.

Motohiro Sato is a professor at Hitotsubashi University.

The views expressed in this piece are the author's own and should not be attributed to The Association of Japanese Institutes of Strategic Studies.