Research Group on 'The Middle East and Africa' FY2021-#8

"Research Reports" are compiled by participants in research groups set up at the Japan Institute of International Affairs, and are designed to disseminate, in a timely fashion, the content of presentations made at research group meetings or analyses of current affairs. The "Research Reports" represent their authors' views. In addition to these "Research Reports", individual research groups will publish "Research Bulletins" covering the full range of the group's research themes.

Economic Development of GCC Countries and the Belt and Road Initiative

Economic relations between the Gulf Cooperation Council (GCC) countries (Saudi Arabia, the United Arab Emirates (UAE), Qatar, Kuwait, Oman and Bahrain) and China have been expanding since the 1970s, mainly through trade in oil resources. However, China's dependence on the GCC countries for oil has further increased since China turned into a net oil importer in 1993 in line with growing domestic energy demandi. On the other hand, the GCC countries have been seeking to transform their industrial bases and attract foreign investment with the aim of achieving long-term economic development by weaning themselves from oil dependence and diversifying their economies. The importance of foreign direct investment has been highlighted in recent long-term economic development plans, such as Vision 2030 revealed in 2016 by Saudi Arabia, and Projects of the 50 announced in 2021 by the UAE.

For the GCC governments that adopted such development policy, the announcement of China's Belt and Road Initiative (BRI) was seen as an opportunity to attract investment to their countries. The initial objective of the BRI announced by the Xi Jinping administration in 2013 was to strengthen political and economic ties among the countries along the "Silk Road Economic Belt," a land route from China to Europe via Central Asia, and the "21st Century Maritime Silk Road," a sea route from the South China Sea to Europe via the Indian Ocean. The GCC countries lie outside those two main routes, but due to the expansion of the BRI itself and the transformation of foreign cooperation, there have been moves made in the UAE and other GCC countries since 2019 to support the BRI. The UAE, which wants to diversify its economy and attract foreign direct investment, hopes to derive economic benefits by partly cooperating with the BRI. In this report, I will outline how the GCC governments, and the corporate sector are involved in the BRI and what economic effects are expected, focusing on the case of the UAE.

UAE and the BRI

(1) UAE's Participation in the BRI

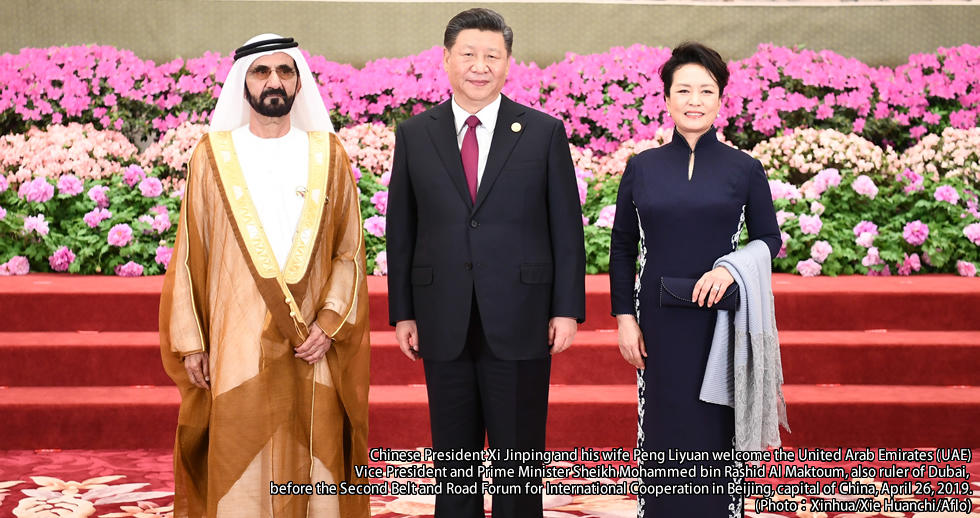

The UAE's participation in the BRI has been widely touted on the ground with the announcement of a number of new joint projects. For example, in his meeting with President Xi Jinping, Sheikh Mohammed bin Rashid Al Maktoum, the Emir of Dubai as well as Vice President and Prime Minister of the UAE, who attended the second Belt and Road Forum for International Cooperation held in Beijing from April 25 to 27, 2019, announced that the UAE would fully support the BRI. At that time, a new contract worth $3.4 billion was signed between the UAE and China that was expected to further enhance bilateral trade and investmentii. As a specific large-scale project, a partnership between DP World, a government port management company in Dubai, and Zhejiang China Commodities Group was announced through which $2.4 billion would be invested to build a trade promotion hub, the Dubai Traders Marketiii, near the Dubai Expo site. It aims to export Chinese products around the world through this base. As the first phase of the project, "Yiwu Market" will be opened, and more than 1600 showrooms and 324 bonded warehouses will be developed.

DP World has also agreed with Chinese companies, including China-Arab Investment Fund Management, to invest $1 billion to build Vegetable Basket in Dubai, a hub for the import, export, processing and packaging of agricultural and fishery products and animal products for BRI countriesiv. the UAE Government's economic development strategy, which aims to develop the UAE into a regional and international trade hub, to promote exports of no-oil products, and to improve food security issues (Saito, 2019).

Dubai is already home to Dragon Mart, a trading hub built in 2004 by government property developer Nakheel. And in July 2018, Emaar Properties, another government property developer, announced that Dubai Creek Harbour would develop the largest Chinatown in the Middle East to strengthen ties with Chinav. The announcement of the UAE's participation in the BRI and major investment projects can be seen to strengthen the economic partnership between the UAE and China and aim to make the UAE an international hub for trade in Chinese goods.

(2) China's Entry into the UAE through the BRI

I would like to clarify the characteristics of the forays made by the Chinese government and companies into the UAE under the BRI. While the GCC countries are not necessarily the main investment destinations for China's BRI, the UAE is seen as a main partner in the GCC. According to the China Global Investment Tracker database of the American Enterprise Institute (AEI)vi, China's investments in the UAE under the BRI totaled $7.34 billion between 2013 and 2020 (Table 1), with the largest shares coming from China National Petroleum Corporation (CNPC) and China National Offshore Oil Corporation (CNOOC) in the energy sector ($1.77 billion in 2017, $1.18 billion in 2018). In addition, the amount of construction contracts in the UAE by Chinese companies promoted under the BRI was $21.2 billion, of which contracts in the energy sector ($10.1 billion, 47.7% of total contract value) and the real estate sector ($5.64 billion, 26.6%) are prominent. Most of the contracts were signed between China Building Corporation and government companies in both countries, including ADNOC, Nakheel and Damac. So far, the entry of the Chinese government and companies into the UAE through the BRI has focused on the energy and real estate sectors.

Table 1 Chinese investment in GCC countries and construction contracts under the BRI (2013-20)

Investments |

Construction contracts |

|||

Value (US$10 million) |

Share of global |

Value (US$10 million) |

Share of global |

|

UAE |

73.4 |

2.3 |

211.9 |

4.1 |

Saudi Arabia |

23.2 |

0.7 |

238.3 |

4.6 |

Qatar |

n/a |

n/a |

38.3 |

0.7 |

Kuwait |

6.5 |

0.2 |

77.7 |

1.5 |

Bahrain |

n/a |

n/a |

14.2 |

0.3 |

Oman |

12.1 |

0.4 |

43.8 |

0.8 |

Total (GCC) |

115.2 |

3.6 |

624.2 |

12.0 |

Total (global) |

3,212.6 |

100.0 |

5,222.5 |

100.0 |

Note: n/a (not available) indicates that data is not available.

Source: Compiled by the author based on American Enterprise Institute (AEI)"China Global Investment Tracker"

Conclusion

The UAE government is believed to be taking advantage of China's BRI to expand trade with China and draw in Chinese funds. However, it is not clear how committed the UAE government and companies will remain to the Chinese economy, given the deepening conflicts between the United States and China, the transformation of the BRI, and trends in international decarbonization and their consequent effects on oil prices. For example, the Chinese government proposed the "Digital Silk Road" in 2015 as part of the BRI, shifting its focus from building transportation infrastructure and trade networks to accelerating the global deployment of information and communications technology. In 2019, the UAE joined the China-led Initiative for International Cooperation on the Digital Economy and is pushing ahead with the introduction of 5G services through Huawei devices already in use in the country. However, it is unclear how the UAE will respond to moves by Western countries to eliminate Huawei's products.

Moreover, the recent recovery in oil prices may dampen the willingness of oil-producing countries, including the UAE, to reform their economies and reduce the need for economic partnerships with China. China is just one of several economic partners for the UAE, whose trading partners and investment destinations already indicate a certain degree of economic diversification. The UAE, one of the major economic powers in the Middle East, is also increasing its influence on the economies of neighboring Arab countries and South Asian countries. The steering of the UAE's economic relations with China can, in turn, affect the economies of neighboring countries. It is necessary to keep a close watch on its relations with China in order to foresee the future of the Middle East economic zone centered on the UAE.

(The original Japanese version of this paper is dated November 18, 2021.)

i China's share in the export value of mineral fuels in the GCC countries has increased. In 2020, China's share was estimated to be 16% in the UAE, 25% in Kuwait, 16% in Qatar and 3% in Bahrain (Trade Map Data, International Trade Centre). The data for Saudi Arabia and Oman are unavailable. According to the Saudi government's crude oil export statistics, export destinations are classified by region, such as Asia, and no country-specific statistics are available. Official data from oil-producing countries often make it difficult to provide accurate destination country figures. The same applies to Oman (Fukuda, 2017).

ii WAM (July 18, 2019) (accessed November 11, 2021, https://wam.ae/en/details/1395302774929).

iii "Dubai Traders Market" website (accessed November 3, 2021, https://dtm.ae/about-us/).

iv Press release from JAFZA (accessed November 6, 2021, https://jafza.ae/news/mohammed-bin-rashid-witnesses-launch-of-traders-market-in-dubai/).

v July 18, 2018 article in the Khaleej Times (accessed November 11, 2021, https://www.khaleejtimes.com/uae/dubai-to-see-middle-easts-largest-chinatown-project).

vi This database lists Chinese overseas investment amounts and overseas construction contracts (accessed November 11, 2021, https://www.aei.org/china-global-investment-tracker/).

References:

Jun Saito. 2019. "Agricultural Policy and Overseas Agricultural Investment in the United Arab Emirates", Middle East Review, 6, pp. 23 -29. Institute of Developing Economies (in Japanese).

Yasushi Fukuda. 2017. "China and the Gulf Region: Crude Oil-Centered Relations and Their Development", Middle East Review, 5, pp. 23 -33. Institute of Developing Economies (in Japanese).