Research Group on 'Global Issues' FY2021-# 2

"Research Reports" are compiled by participants in research groups set up at the Japan Institute of International Affairs, and are designed to disseminate, in a timely fashion, the content of presentations made at research group meetings or analyses of current affairs. The "Research Reports" represent their authors' views. In addition to these "Research Reports", individual research groups will publish "Research Bulletins" covering the full range of the group's research themes.

Asia and climate change

(Carbon emissions in Asia)

Asia has become the largest emitter of Greenhouse Gases (GHGs) in the last 20 years due mainly to rapid economic growth and its heavy dependence on fossil fuels. In fact, almost half of global GHG emissions are from Asia, and Asia's energy supply is overwhelmingly reliant on fossil fuels, particularly on coal. Given the above, the UN Secretary General warned Asia in 2019 to quit its "addiction" to coal. Indeed, global decarbonisation is not possible if Asia does not make substantial progress towards carbon neutrality.

Carbon emissions in Asia differ greatly by country. China is by far the biggest emitter, followed by India, Japan, Indonesia and Korea. One of the notable features of Asian emissions is the significant dependence on coal. The shares of coal in both the power generation and capacity of Asian countries are quite high, and Asia as a whole accounts for more than 70% of global coal capacity (UNESCAP 2021). There are still many coal-fired power plants planned in Asia, and future emissions from the region are likely to increase, which is obviously not in line with the Paris Agreement benchmarks (Climate Analytics 2019).

In terms of final energy consumption, industry occupies the largest share in Asia, followed by the transport and building sectors. Thus, decarbonisation in Asia requires a fundamental transformation in these sectors. As to industry, energy-intensive sub-sectors such as steel, cement, and chemicals are of particular importance. Decarbonisation of these industries will need innovative technologies such as hydrogen-based iron production and electrification of many production processes.

(Vulnerability to climate change)

Asia is among the most vulnerable regions to climate change. An increasing number of Asian countries are suffering more frequent large typhoons, floods, droughts, heat waves and forest fires. The benefits obtained through reduced climate damage with 1.5 degrees of warming are estimated to be far greater than those with 2 degrees. In Asia, such benefits are likely to be enjoyed mostly by countries in South and Southeast Asia, indicating these sub-regions are most vulnerable to climate impacts (Climate Analytics, 2019).

Positive and negative drivers for decarbonisation

(Positive drivers)

The EU announced its Green Deal initiative in 2019, and subsequently took a series of specific actions for sound implementation via formal legislation and sizable budgeting. China followed suit by committing itself to carbon neutrality by 2060. The Biden Administration took swift action to promote the US Green New Deal, and organized the Climate Leaders' Summit in April 2021, which pushed many major countries to commit themselves to carbon neutrality by 2050.

In Asia, an increasing number of countries have announced plans for carbon neutrality. The ASEAN State of Climate Change Report indicates a goal of ASEAN achieving net-zero GHG emissions as early as possible after 2050 and the peaking of GHG emissions as early as possible after 2030. Singapore has committed to carbon neutrality as soon as possible in the second half of this century. Indonesia has announced net-zero GHG emissions by 2060 and a peaking of GHG emissions in 2030, while Thailand has committed itself to net zero sometime between 2060 and 2070.

However, these national commitments of Asian countries lack specific time-bound actions. To what extent these long-term commitments will be achieved in the future depends upon, for example, the level of international assistance to be provided. Without detailed milestones, there is a risk that such long-term commitments may not be adequately acted upon in the first place.

(Negative drivers)

A number of drivers have been identified that sustain coal dependence in many countries in Asia (UNESCAP 2021). First, rapidly increasing energy demand in most Asian countries is an overall background driver. Second, coal-rich countries in Asia such as China, India, and Indonesia have a long history of relying on coal, which together with misguided concepts (such as "coal is still the cheapest source of energy") have reinforced the inertia to stick to coal. In cases where coal is an important export item (e.g., Indonesia), government support tends to be more prominent. Various subsidies and public finance are provided by both central and local governments because coal mining generates jobs and revenue for local governments. Another driver is institutions. Many Asian countries have state-owned enterprises for coal mining and coal power generation, resulting in significant investment in coal. This has become a barrier to substantial introduction of renewables by, for example, blocking the energy sector reforms necessary to establish a well-functioning renewables market (IRENA 2018).

There is an international driver as well. Multilateral development banks (MDBs) such as the World Bank and the ADB, as well as the bilateral finance institutions of China, Korea, and Japan in particular, have funded substantial investments in coal. However, this situation is changing. MDBs and the bilateral institutions of China, Korea and Japan have recently announced that they will not be supporting unabated coal power generation going forward. On the recipient side, the Philippines announced a moratorium on new coal-fired power plants in 2020. In Indonesia, PLN, a state-owned enterprise, has announced its commitment to carbon neutrality by 2060.

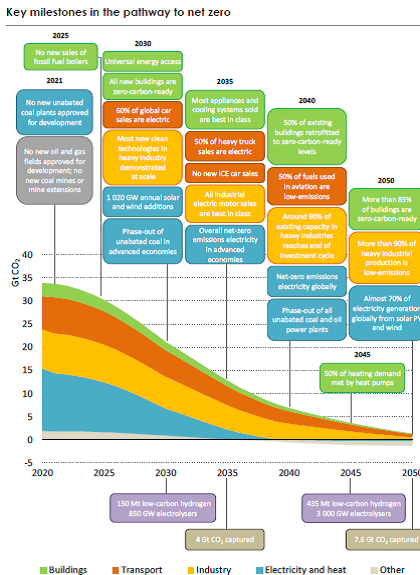

Pathway to net zero

In 2021, the IEA published a groundbreaking report entitled "Net Zero by 2050 - A Roadmap for the Global Energy Sector" which stated that "The path to net‐zero emissions is narrow; staying on it requires immediate and massive deployment of all available clean and efficient energy technologies". The report presented as many as 400 key milestones on the pathway to net zero, as shown in Fig. 1. These key milestones are underpinned by two distinctively different types of technologies, i.e., Type 1 technologies to be added to conventional fossil-based systems so that emissions can be removed later, and Type 2 intrinsically carbon-free technologies such as renewables, including solar and wind power, backed by batteries and smart grids. Based upon this understanding, the following two distinctive scenarios can be developed:

Fig. 1

Lock-in Scenario

Under this scenario, social and technical systems basically undergo incremental changes, and future energy and land systems are determined mostly in a path-dependent manner. Technologies under the Lock-in Scenario belong to Type 1, basically complementary to existing facilities and infrastructures. Utilization of such technologies to the maximum extent will minimize the risk of asset stranding.

Specific technologies in this category could include negative emission technologies such as Carbon Capture, Utilization and Storage (CCUS). Also included are hydrogen technologies because they are mostly compatible with fossil fuel power plants and local heating/cooling systems already in place. Furthermore, hydrogen will be utilized for energy-intensive industries such as steel and chemicals as well as heavy-duty vehicles. In addition, fuel switching from coal to gas for local environmental improvements falls under this category.

Under this scenario, existing facilities and infrastructure continue to be utilized to the extent possible and the potential negative impacts to be generated as a result of the closure of coal mines and fossil-based facilities could thus be rather more gradual than those under the Transition Scenario.

The following are regional and international updates on a few key technologies under this scenario:

(CCUS)

Substantial government support has been provided for Carbon dioxide Capture and Storage (CCS) over years, but only 21 large-scale CCS facilities are in operation now (Global CCS Institute 2020), and only two are linked to power generation. The biggest challenges to widespread application of CCS include higher costs and incomplete CO2 capture. The use of captured CO2 in relevant chemical processes has attracted considerable attention, but its potential is now considered limited (UNESCAP 2021).

However, many countries have significant expectations for CCUS and other negative emission technologies, tying CCS not only to electricity generation but also to heavy industries such as steel and cement. If CCU is connected to direct air capture (DAC), negative emissions could be realized. Large amounts of CO2 to be potentially captured by DAC may not be stored underground, however, due to limited sites suitable for CCS.

(Hydrogen)

Significant international attention is being paid to the production and use of hydrogen. Nevertheless, only green hydrogen is consistent with decarbonisation. Green hydrogen is defined as hydrogen produced from water electrolysis with "zero-carbon electricity", and countries such as Japan, Australia, Korea and Saudi Arabia are currently promoting various projects to develop and deploy this technology in the near future, keeping in mind the potential significance of regional hydrogen trade for certain industries (Zhiyuan Fan et al. 2021). What constitutes "zero-carbon electricity" could be a contentious point. In cases where green hydrogen is produced using fossil fuels combined with CCS and transported over a long distance, the total cost could potentially be considerably high.

(Fuel switching)

Comprehensive air pollution control plans in China have reduced not only air pollutants but also CO2 emissions. From 2017 to 2019 China implemented the Hebei Province Air Quality Action Plan featuring the most stringent emission standards to reduce emissions from major industries. In addition to certain factories being closed and relocated, many traditional coal stoves were replaced by gas stoves, and more than 4,000 diesel buses were phased out and replaced with electric buses. As a result, PM2.5 concentration levels were decreased by almost 40 percent, and annual CO2 emissions were reduced by six million tons (World Bank 2020). However, more than one million jobs were lost as a result. Solid remedial actions such as compensation and job training should have been introduced from the beginning.

Transition Scenario

Under this scenario, social and technical systems undergo transformative change in moving towards net zero. Future energy and land systems are based on carbon-free Type 2 technologies such as solar and wind power backed by batteries, supplanting existing fossil-fuel based facilities and infrastructure.

More specifically, technologies under this scenario comprise not only solar photovoltaics (PV), onshore/offshore wind, geothermal and wave/tidal power, but also electric vehicles (EVs), heat pumps, and electric arc furnaces as well as energy storage technologies such as batteries backed by smart grids. Most of these are already available, but some need further R&D for actual deployment. They will basically replace, rather than complement, existing fossil fuel-based technologies. For those technologies that are already competitive, policies and practices to help deploy and disseminate them extensively are needed.

Keeping the above in mind, a few encouraging cases have emerged in the Asian region:

(Carbon pricing)

Carbon pricing, typically carbon tax and emissions trading, is a fundamental measure to reduce fossil fuel use and to promote renewables. Japan was the first among Asian countries to introduce a carbon tax in 2012. In ASEAN, Singapore introduced such a tax in 2019. However, the tax levels in these two countries are considerably lower than those in European countries. China has already introduced its ETS (Emission Trading System) in the electricity sector at the provincial level, and started actual trading in a national carbon market in July 2021. China plans to expand its ETS to cover key industrial sectors as well in the near future. Korea has also introduced and gradually strengthened its emission trading, and it now plans to further enhance its ETS to help achieve carbon neutrality by 2050. Other countries are likely to follow. Indonesia is considering introducing a domestic ETS in 2024.

However, carbon pricing is not the only policy for realizing net zero. It should be understood within a broader package of policies aimed at net zero, which include policies to spur renewables and reduce barriers to full electrification for industries.

(FIT)

FIT (Feed-in Tariff) has been introduced in many countries in Asia now, but the extent to and speed at which renewables are deployed vary from one country to another. A recent remarkable case is Vietnam, where FIT was introduced in 2017. By 2020 as much as 16.5 GW of solar PV, both rooftop and utility scale, was successfully introduced, accounting for about 25% of the national power system's total installed capacity. Under the National Power Development Plan 2021-2030, the government now envisages building 50 GW in wind and solar power capacity by 2030 (Thang Nam Do et al. 2020).

Another noteworthy case is India. India has been promoting renewables for many years. A separate ministry has been in place since 1992 to promote renewables. In 2017, wind power capacity reached 33 GW and solar 18 GW, together constituting about 5% of the electricity mix. Furthermore, India has moved from FIT to reverse auction to secure low-price contracts for solar and wind power, thereby establishing in India the world's most competitive solar markets (Burke P, 2019).

(Grid connectivity for renewables)

Currently, only a limited amount of electricity is traded across borders in Asia, most prominently between Laos and surrounding countries. As renewable-based electricity increases, though, cross-border electricity trades will become essential for dealing more effectively with the fluctuations in electricity generation associated with renewables. In this respect, the ASEAN Power Grid (APG) is worth mentioning. It was already conceptualized in 1986, and is now recognized as one of the key initiatives under the ASEAN Plan for Energy Cooperation (APAEC) to promote multilateral electricity trading. In 2015 IRENA launched an initiative to help integrate renewable-based electricity into the APG. Similar initiatives to reinforce multilateral electricity connectivity exist in South Asia and Northeast Asia (IRENA 2018).

Technologies common to Lock-in and Transition Scenarios

(Energy conservation)

Energy conservation is essential for both scenarios since future energy demand is very much dependent upon the extent to which energy efficiency will see progress. Most countries in Asia have long implemented policies and practices to promote energy efficiency in various ways.

The energy intensity of ASEAN countries gradually improved from 1995 for the next 20 years. The ASEAN Plan of Action for Energy Cooperation (2016-25) has set a long-term goal of reducing energy intensity by 20% by 2020, and 30% by 2030. Certain regional initiatives have been promoted, including ASEAN SHINE, a regional initiative for the harmonization of standards for specific appliances such as air conditioners. In addition, various energy efficiency measures have been introduced and applied under the Plan of Action to sectors such as construction and transport in manners considered appropriate (IRENA 2018).

National strategies towards zero carbon

Asian countries face tremendous challenges in achieving carbon neutrality. In general, countries heavily embedded in fossil fuels are confronted with serious difficulties in breaking the inertia and moving out of the carbon quagmire, while countries with abundant renewables may take a more proactive stand on transitioning towards zero carbon. Countries find themselves in a diversity of circumstances. Some countries are rich in both fossil fuels and renewables (e.g., Australia), while others are endowed with only one of these (e.g., Brunei with fossil fuels, and Bhutan with renewables). A few countries even lack both of them (e.g., Singapore).

However, the technical and financial capacity developed and sustained by a country is also important. Countries with robust technical and financial capacities are considered to have more leeway in developing their own strategies towards net zero. However, countries with limited capacities need to take into account the level of international support to be provided to complement their insufficient capacities. Substantial assistance has been committed by developed countries in terms of finance and technology transfer under the Paris Agreement. Still, technology transfers to recipient countries have encountered significant obstacles so far. Innovative policies and practices to break down these barriers should be explored.

The circumstances surrounding countries differ substantially in terms of natural resources (i.e., endowments of both fossil fuel and renewable energy resources) and human resources (i.e., national technical and financial capacities). Thus, each country needs to develop its own unique strategy, fully considering its own natural and human resources, by effectively combining Type 1 and Type 2 technologies and strategically planning for the years leading up to mid-century. Indeed, countries will likely differ considerably in which options are introduced to what extent and how swiftly.

There seem to be four key perspectives for developing a national zero-carbon strategy. The first is "energy security", which sets the overall framework for strategic national planning. The second perspective is "economy", which dictates the least costly pathway over the long term. The third is "environment", which sets specific long-term goals towards zero carbon. In addition, "social implications" are considered important to ensure compatibility with SDGs.

(Energy security)

A few Asian countries have significant amounts of fossil fuels. In ASEAN, for example, Indonesia is endowed with coal, oil and gas, Malaysia with oil and gas, and Vietnam with coal. As energy demand expands, however, the share of domestic resources starts to come down. Vietnam became a net energy importer in 2015. Continued increases in energy demand are likely to decrease the share of domestic resources considerably. This will further erode energy security in most ASEAN countries in the future.

On the other hand, all countries in Asia except for Singapore and Brunei have abundant renewable energies. Solar energy alone could supply many more times the energy consumed in 2016 in most countries if only 1.5% of national land were utilized for solar photovoltaic generation. In addition, Asian countries have many other renewable sources, including hydro (Laos), geothermal (Indonesia and the Philippines), and biomass (Indonesia). Thus, the energy security of most ASEAN countries will improve as they take up more renewables. This is true with other Asian countries as well.

(Economy)

Many Asian countries spend substantial funds to import oil, coal and other fossil fuels. For example, Japan currently spends about 3% of GDP annually on fossil fuel imports, while ASEAN countries are equally or even more dependent on fuel imports as Japan (e.g., Indonesia: 2.7%, Vietnam: 3.5%, and Thailand: 6.2%). Full decarbonisation could save these funds for investment in other national priorities (Climate Analytics 2019).

In addition, massive development of renewables tends to invigorate local economies within countries, as renewables are predominantly available in remote areas. In addition, developing renewables by fully involving communities and other local stakeholders will generate substantial jobs throughout a country. The IEA's net zero report indicates actions towards net zero will globally generate about 30 million new jobs by 2030, while about 5 million jobs will be lost in the same period.

(Environment)

Decarbonisation will drastically improve and eliminate air pollution and all other negative impacts generated by the use of fossil fuels. Almost all major cities in developing Asia presently suffer from unbearable air pollution. The IEA's net zero report estimates premature deaths caused by air pollution will be reduced worldwide by two million annually. Also important is recognizing the fact that those exposed to higher levels of air pollution tend to be more vulnerable to COVID-19. Urbanization is likely to continue in Asia, so this air pollution co-benefit should be acted upon to the maximum extent in Asia for future generations.

(Social implications)

Zero carbon transformation could generate a few social co-benefits. A mini-grid backed by solar photovoltaic power could provide access to electricity in remote villages. Improved electricity access would make it possible for village children to study after dark. Gender-related issues could also be addressed in many ways, for example, by freeing women from the indoor pollution prevalent in kitchens using traditional biomass. Furthermore, decentralized energy systems will enhance local resilience to natural disasters, including those induced by climate change.

However, it is also important to recognize the trade-offs associated with decarbonisation. For example, a coal phase-out is likely to have seriously negative impacts on local workers and communities in coal mining areas. Large-scale solar developments may also adversely affect the livelihoods of local people by weakening their land rights and access.

References:

Burke. P 2019: Overcoming barriers to solar and wind energy adoption in two Asian giants: India and Indonesia

Climate Analytics 2019: Decarbonising South and South East Asia, available at Climate Analytics 2019: Decarbonising South and South East Asia

Global CCS Institute 2020: Policies-Global CCS Institute, available at https://co2re.co/FacilityData

IEA 2021: Net Zero by 2050, A Road Map for the Global Energy Sector, available at https://www.iea.org/reports/net-zero-by-2050

IRENA 2018: Renewable Energy Market Analysis, Southeast Asia, available at https://irena.org/publications/2018/Jan/Renewable-Energy-Market-Analysis-Southeast-Asia

Thang Nam Do et al. 2020: Underlying drivers and barriers for solar photovoltaics diffusion: the case of Vietnam, Energy Change Institute, Australian National University.

Tokyo Metropolitan Government 2021, available at https://www.kankyo.metro.tokyo.lg.jp/en/climate/cap_and_trade/index.files/ResultsintheSecondPeriod.pdf.

UNESCAP 2021: Coal Phase-out and Energy Transition Pathways for Asia and the Pacific, available at https://www.unescap.org/kp/2021/coal-phase-out-and-energy-transition-pathways-asia-and-pacific

World Bank 2020, available at https://www.worldbank.org/en/results/2020/05/07/breathing-easier-supporting-chinas-ambitious-air-pollution-control-targets

Zhiyuan F. et al. 2021: Green Hydrogen in a Circular Carbon Economy: Opportunities and Limits, Columbia/SPIPA, Center on Global Energy Policy, available at https://www.energypolicy.columbia.edu/research/report/green-hydrogen-circular-carbon-economy-opportunities-and-limits